Life after ICO: LAToken turned out scam not blockchain (Valentin Preobrazhenskiy) — part 1 . - «Бизнес»

Предыдущая

1 of 27

Следующая

Life after ICO: LAToken turned out scam not blockchain (Valentin Preobrazhenskiy) — part 1

Add:

- Life after ICO: LAToken turned out scam not blockchain (Valentin Preobrazhenskiy and the Biznes Molodost) — part 2

- Life after ICO: LAToken turned out scam not blockchain (Valentin Preobrazhenskiy and the Biznes Molodost) — part 3

- ICO LAToken Валентина Преображенского: Мошенничество вместо блокчейна (1 часть на русском)

- ICO LAToken Валентина Преображенского: Мошенничество вместо блокчейна (часть 2 на русском)

- ICO LAToken Валентина Преображенского: Мошенничество вместо блокчейна (часть 3 на русском)

- Scamlatoken.com

Life is marvelous thing. You plan one thing but get another one. As in a startup — surprising pivot and whole change in concept. This is how it happens: you work as digital marketing manager and bbbaaanggg! — you become an analyst and crypto critic. However you had stayed as marketing expert. Or sometimes you do startup, make yourself busy leader, you are being Forbes mentioned, draw great plan, pitch investors in various countries, start massive ICO, harvest good cash and bang! — you have pathetic exchange service in your hands. Meaningless, incoherent, impudent exchange service. Because of pivot. “Sorry guys, can’t help, concept has changed.” Typical buffoon circus for the investors’ money.

What’s good in ICO? Classic venture investors require accountability for any kind of a pivot, and they will ask you unpleasant questions. That’s no good. In crypto world things are bit different: you collect money for one reason, then rapidly change your shoes in the fly, invent indistinct shit without any idea and sense — and voila! Project is sort of alive, everybody is busy, nobody needs any explanation. That is a picture of LAToken project very promising in the past (https://latoken.com/).

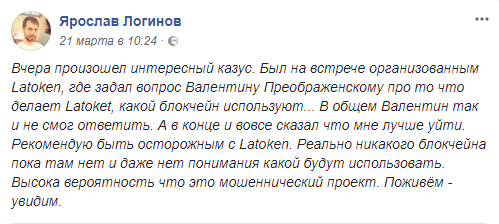

Promised one thing, did another one. Blockchain (even if in presence) is so hidden for good that no one could find it. For any questions Valentin Preobrazenskiy, LAToken founder, (https://www.facebook.com/valentin.preobrazhenskiy) usually does not want to give answers on tough business questions, and he gazes at you with founder eye and asks you do not bother him and leave the office.

Some words on Valentin Preobrazhensky and “missing blockchain” from very dissappointed crypto-enthusiast. Source: https://www.facebook.com/prof1983/posts/1900471539985842

Source: http://firrma.ru/data/news/80761/

Source: https://fomag.ru/news/pyat-krupneyshikh-it-sdelok-goda-po-versii-finama/

Must thank Valentin Preobrazenskiy for changes in my life. Because it had happened after having high words with him in his office in 5, Mansurovskiy pereulok, 2nd floor. Just that very case had defined my cryptocritic way now.

https://www.google.ru/maps/@55.739797,37.5948252,3a,75y,239.7h,103.06t/data=!3m10!1e1!3m8!1spqceuiBr73moEInjirpGFg!2e0!6s%2F%2Fgeo2.ggpht.com%2Fcbk%3Fpanoid%3DpqceuiBr73moEInjirpGFg%26output%3Dthumbnail%26cb_client%3Dsearch.TACTILE.gps%26thumb%3D2%26w%3D96%26h%3D64%26yaw%3D205.36075%26pitch%3D0%26thumbfov%3D100!7i13312!8i6656!9m2!1b1!2i33

How did it happen that in summer 2017 I had watched with curiosity on crypto and had reflected upon newly opened professional and career opportunities? After I left one of well known invest company (where CEO with his lack of will and apathy had successfully led the company to the end) I had not found myself in crowd investing in IIDF (Internet Initiatives Development Fund, Russia) (where personnel had negotiated in a strange way, and they only now started to understand what I had written to them on those meeting), and had been disappointed in Russian invest companies (because it is impossible to be that stupid, and hate customers that much), that I had bypassed a lot…

“Doing business in Russia is a choice for poorly educated and overconfident badasses”. Source: https://www.facebook.com/Dmitry.Mendrelyuk/posts/1756224211083193

…I was going to continue my way in digital marketing anyway. Especially newborn hype around crypto promised me exciting professional perspectives: use of a bunch of marketing tools, ambitious goals, adequate budgets, global targeting, new branches and products, tough deadlines and business madness — “everything we like”. From the other side it was excellent investigation opportunity to find out what crypto people think. And my skepticism had arisen from accurate assessment of the numerous “projects” that I had used to look through. The matter was that there were a lot of applicants for money who had been coming to Alexander Vedeneev to be “urgently invested in their ICO”. Alexander had strong lack of time to dig into that crypto trash, and sent me links and white papers for assessment. So I had become “mom’s crypto analyst” (“mom’s” as an equivalent to “newbie”).

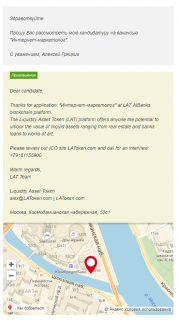

It was not difficult anyway. Often it was enough common sense and attentiveness to evaluate any crypto project. Well, it was summer 2017 — the time of crypto trash and fun, and I read a lot of strange ICO white papers to understand how and where ICOs had been trying to swindle the investors. Nevertheless, I “learned fairly enough, grew bolder, and decided join the battle with one of them” [quote from the “Billiard” song by Billy’s Band]. So I went to see the LAToken team to understand are they adequate or not (because their website was real shit those days). Also I wanted to listen to the things had not been said in their investor presentations. So I went there for job interview. Sometimes meeting the company’s hirer is very valuable source of information about company and its competitors. Another benefits were to improve my professional skills and take part in new movement. Moreover it had been promised to be paid fairly.

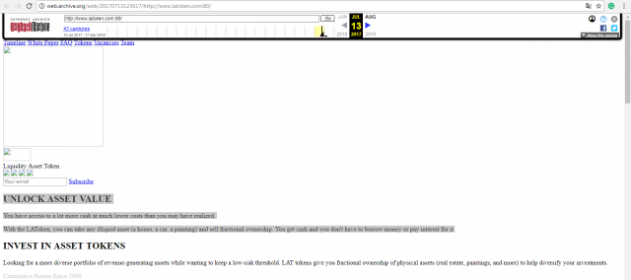

I arranged meeting with Preobrazhenskiy assistant Alexandra Petrova (now she is PR Manager of the Token Fund, see contacts here or here). And so I arrived for the interview and spoke to Valentin about my experience. Also I mentioned that their product had been being quit raw from the business point, that their website had been looking quite indistinct, and that had been being important to work on product and its packaging before buying traffic from Facebook and Google Adwords. ==== The first website version, July 2017 (saved partly): http://web.archive.org/web/20170713123617/http://www.latoken.com:80/ Here is August 18th, 2017 version: http://web.archive.org/web/20170818233436/https://latoken.com/

====

Nevertheless, in spite of my eloquence the Valentine’s face in his spectacles became more serious. That guy just from the street instead of internet marketing trying to teach us about imperfectness of our project, and that it is important to explain to future investors, unveil USP and “close” fears before buying. Also I tormented his brain with pictures with ideas from smartphone and actively draw schemes on paper with a bunch of arrows, Youtube and other.

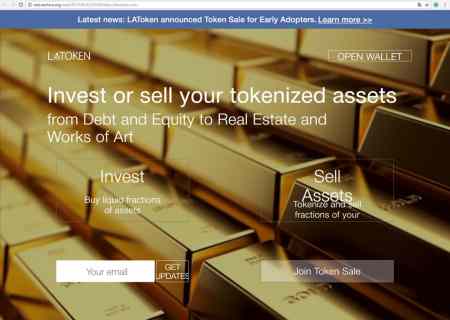

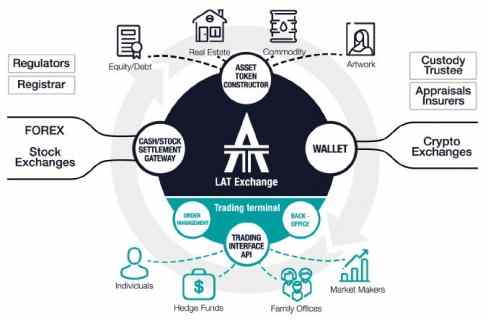

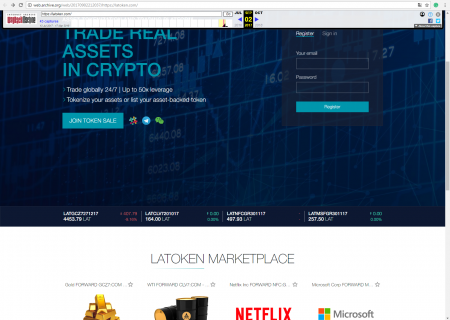

At the end Valentin passed me to his foreign deputy director, whose I said the same ideas. He did not catch everything I said but mentioned that “if You can adjust Facebook that will be more important”. Than Valentin with his complex sayings said he’s busy and ask to go out. After that Valentin will do the same trick when he being asked uncomfortable questions. No guys. Facebook traffic is not as important as business and product things (especially now when it closed for crypto advertising and promo). At that time even not being crypto critic I had got a lot of questions and doubts the LAToken concept (find here) as Liquid Asset TOKEN. Now it is Liquid Asset PLATFORM because Valentin and his friends changed concept using “pivot”. Well, what was in the beginning: “LAToken is blockchain platform for tokenization and global asset trading using cryptocurrencies. The project creates conditions for everywhere using of cryptocurrencies, particularly in real economy sector. Inside the project will be developed its own blockchain platform where users will get opportunities to buy and sell stocks, debts, gold, real estate, art, other assets with use of cryptocurrencies.”

It was supposed that mostly illiquid things will become liquid with the use of cryptocurrencies. First, real estate and art deal flow sometimes takes for years. Moreover stocks, bonds and debts were mentioned as illiquid assets.

Source: https://blog.latoken.com/forbes-latoken-is-going-to-revolutionize-real-estate-7afbe90eb5a6

Source: https://www.inc.com/nicolas-cole/this-startup-wants-to-turn-vehicles-real-estate-an.html

The goal is noble, but here was conceptual question: how one can make illiquid asset to liquid, that no-one wants or price overheated? Otherwise all Rublevka and New Riga (most expensive and illiquid real estate in Moscow) that freezed in sales for years and are not even taken as for debts (’cause nobody knows what to do with those estates then). That real estate owners would happily run to Valentin — and everything will become fine on real estate market. Illiquid assets is that is why illiquid that no-one need the assets in current circumstances. And it does not matter for cryptocurrency or fiat currency. Though for product coupons. And if the real estate or art has in demand — no one needs Valentin’s project. There are a lot of dealers who would happily support and organize the deal. Without LAToken. But it was just first fail of the Preobrazhenskiy project concept. Then was other fail because he went even further and offered to buy and sell the real estate divided BY PARTS.

Source: https://www.investopedia.com/news/latoken-bringing-assets-worth-trillions-blockchain/

“Besides illiquid assets before such as real estate or arts could be tokenized and sold by pieces on our platform. You may for instance buy a piece of Mona Lisa” (watch at 0:55 by the link: https://www.youtube.com/watch?v=9FVHy-GZisg)

Source: https://www.forbes.com/sites/omribarzilay/2017/08/07/will-blockchain-ignite-fractional-ownership-market-for-homes/#611a44a33370

Source: https://blog.latoken.com/inc-latoken-will-make-even-the-most-illiquid-assets-tradable-1345bb7ecbba

About Mona Lisa and Eiffel Tower — these are particular types of joes that Valentine shared, but the tokenization of illiquid assets is amazing, isn’t it?! If useless trash is not sold — you’d better sell it for tokens. Then it’ll be bought (but that’s not for sure). Well, damn with that assets. But how to share rights of possession of stocks, bonds, real estate, arts in parts — that is the question. How to legalize the right of ownership for that in real world? How to implement it according to difference in legislation of diverse of countries? And what does it mean: “Trustee buys the PART of the PAINTING”? (Watch at 3:58 https://www.youtube.com/watch?v=9FVHy-GZisg and at 8:48https://www.youtube.com/watch?v=dmtJNDs3kaY) One thing if it is futures for WTI — you may use variety of tools to buy, sell and share. Or debts, that you may divide into any pieces (and tokenize it). But not the realty, paintings, or stocks! You own it as a whole or not possess. You are registered as owner or not. But jokers from LAToken claimed that those things are easily tokenizable (Watch again at 3:58 https://www.youtube.com/watch?v=9FVHy-GZisg) and become liquid for real. And you get cash fast and easy.

http://web.archive.org/web/20170713123617/http://www.latoken.com:80/

That means that original idea of LAToken reminded the devilish crypto pawnshop. Can’t sell your house or painting ? — you make tokens based on them — and sell those tokens to crypto sectarians. Now house or painting stayed at yours, you’ve got money, and crypto fools owns LATokens. How could be tokens emitted for the PART of house or painting, and how that money and assets would be aggregated back in the future IN DETAILS? Or would it really happened at all? How it will happen in various jurisdictions, with different objects of assets? How and by whom would those assets be assessed? Why should somebody trust that assessment? Where could anyone see full details of the contract? Why does that contract would be validated by various countries legislations? Valentin preferred not to answer that valuable questions being busy startupper.

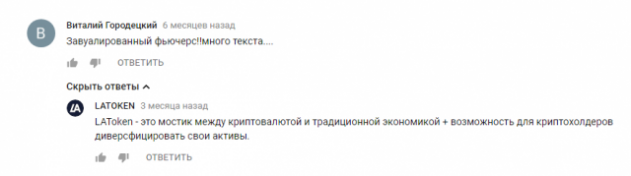

Lots of skepticism in comments on LAToken video — https://www.youtube.com/watch?v=GdldBB3B4Uk

Why one should understand that house or painting is not the standardized commodity like an oil barrel or a wheat bushel, and that many things are based on assessment quality and sale process — if those thoughts deliver headache. Moreover, if one could buyback those tokens emitted by house or painting selling then one needs to sell the house or the painting to somebody. But as we remember those assets are illiquid. So it won’t be sold at all. That means it won’t be money return to investors for the tokens bought, and that is global fraud, isn’t it? Well, maybe it’s wrong thoughts. Here is ICO coming, so no-one needs those sentimentalities the treacherous doubts.

Massive skepticism in comments on LAToken video — https://www.youtube.com/watch?v=GdldBB3B4Uk

But anyway, where is the liquidity? Ok, pawnshop function is visible, but where is the liquidity? And what was meant by liquidity in LAToken? And who and how would select assets for tat tokenization? At such moments Mr. Preobrazhensky made especially “complex face” and did not want to continue talking on the matter.

As a result our epic tale finished predictably in the middle of August 2017: I had been offered money for Facebook and AdWords traffic generation. But I was not going to take part in unclear endeavor without product changes, so I left. At that moment Valentin had done classic pivot and explained that “not all the tokens initiate the change of the ownership, that access means opportunity to buy token adhered to the basic asset’s price. It’s similar to forward contract that doesn’t suppose ownership transmission.” (https://www.youtube.com/watch?v=GdldBB3B4Uk — at 8:53). I just wanted to ask: Valentin, would you please define what you are selling for yourself at least — either you make the illiquid assets liquid, or you multiply the backward derivatives that linked to illiquid assets. Those are different things.

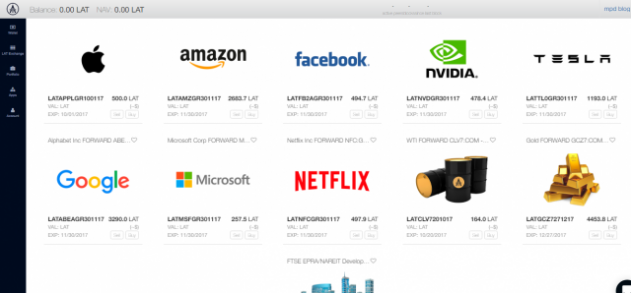

After you’ve got fun out of LAToken answers’ level for those obvious questions to their concept, let’s listen to Preobrazhenskiy in video from September 2nd, 2017: https://youtu.be/GdldBB3B4Uk 3:37 — “Blockchain radically decrease the costs of listing (on exchange)” — Valentin, are you serious? 3:45 — “It [blockchain] also can make accounting reports transparent in real time for investors”. — Valentin, are you sure you understand what blockchain is for? 4:04 — “Now we make derivative token for liquid assets that you one can trade practically without transactional costs” — At this point idea to make illiquid assets liquid had been successfully disappeared. 9:31 — Here Valentin claimed the role LAToken would do. Fairly saying — none. One more shitcoin that prays to support the liquidity of assets and that would be laying for buying other tokens. 15:52 — “At the moment one can already trade tokens bind with shares of Apple, Tesla, gold, oil — but nobody does. We are the first in the world tokenized stocks and commodities”.

====

Here is Sep 2nd, 2017 version of latoken.com: — http://web.archive.org/web/20170902212037/https://latoken.com/

Just one question from potential customer: WHY?? Why does one multiply derivative unsecured shitcoins for premium stocks and commodities, if at any forex one can have leverage for gold, oil, stocks starting from 50 and more? And even on exchanges one can find mini contracts. Play as long as you wish. Why should one trade on LAToken platform namely? Why is all this buffoonery? The history shows that most of potential customers of the LAToken “exchange” asked themselves the same question. 16:25 — “There are large projects, big banks, that move in that direction, and exchanges will go there too — but they will do it for years, but we make it in only few weeks” 18:08 — “To year 2025 we want our platform turnover to exceed $5 TRILLION and this year we will tokenize stocks and debts for $150 BILLION” But in a couple of seconds later it becomes clear that first they will start certain realty index, but it will be started later then (“starting with castle in France”) — and till now no-one knows when. 19:02 — try to decrypt what Valentin exactly said here about application and listing of the third party tokens by every user. Does that means every bum could easily enter his shed through smartphone to the LAToken “exchange”? Or will there be some criterias and procedures? If yes then where are any details? 22:55 — Here Preobrazhenskiy explained how differ the “normal” project form “scam”. That is extremely touching. If one has not a lot of fun from that video, then there is continue of the buffoonery and sad verbiage find here: https://www.youtube.com/watch?v=9FVHy-GZisg Especially, the “joke” about Mona Lisa selling by parts is pretty good (at 0:55 and 3:58), the pathetic try to explain why one needs LAToken in simple words (Preobrazhenskiy gave nonsense words in the best traditions of corporate employees or state officials), and he gave uncovered investors’ fraud suggestion saying that their tokens will be frozen for 10 (!) years (at 6:45). Also one can listen to LAToken CEO here: https://www.youtube.com/watch?v=dmtJNDs3kaY (September, 20th, 2017) Here one can listen that “may be even paintings” [will be tokenized]. Also there would be “NASDAQ and Amazon on blockchain”, and “we plan costs for business development for $1 BILLION” and “billion dollars turnover in a month in the middle of the next year” [2018]. Yes, Valentin said that.

If you want to listen to that defective concept without Valentin’s mumbling and more in details, so here (https://www.youtube.com/watch?v=VLrMgCV1Fpw) another crypto enthusiast tried to explain the LAToken business model and assets selling/buyback details. But it did not answer all crucial questions. Even that crypto guy on video could not clearly understand how it would really work. In another video guys also did not got the LAToken business scheme https://www.youtube.com/watch?v=dmtJNDs3kaY from 8:48. The most sticking points were the assets’ ownership transfer process and legal regulation of that. Especially recommended to mention the verbiage in the LAToken ICO White Paper of “pink elephants” about issuing of a BILLION tokens (and just 15% would be sold in the market) and about $40 mln would derive from the tokens sale (from 23:10). Well, my skepticism is one thing. Always one may say to me the “universal argument” — “you had not been taken for that job, so you write libels in return”. So let’s listen to other crypto boys.

Следующая похожая новость...